Td High Interest Savings Account

- Td High Interest Savings Account Fees

- Td High Interest Savings Account

- Td High Interest Savings Account

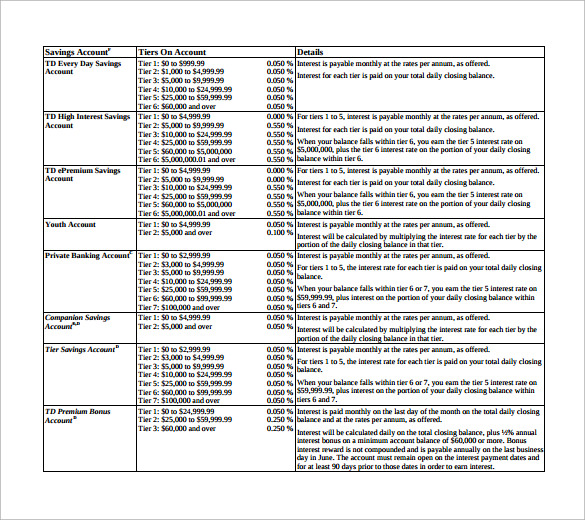

- Td Interest Rates Savings

A TD Beyond Savings IRA may be a good choice if you want a competitive interest rate and the flexibility to make contributions at any time $20,000 opening deposit Additional contributions allowed 3. If you're looking for a new savings account available nationwide, TD Bank Savings is offering you 2.50% APY on your funds for opening a new TD Preferred Savings Account. Below is all the information you need to earn 2.50% APY Rate on your funds when you open a TD Bank Preferred Savings Account. Relationship discount may be terminated and the interest rate may increase upon closure of the qualifying personal checking account. 2 TD Bank Mobile Deposit is available to Customers with an active checking, savings or money market account. Plan Highlights. High interest rate. Earn interest calculated daily, when your account balance is $10,000 or more. Free online transfers. Enjoy unlimited free online transfers to your other TD deposit accounts 2. TD Beyond Savings: 0.01%: $0.01-$19,999.99: TD Beyond Savings: 0.05%: $20,000-$49,999.99: TD Beyond Savings: 0.10%: $50,000-$99,999.99: TD Beyond Savings: 0.15%: $100,000-$249,999.99: TD Beyond.

Are you 60 or older?

This is the perfect account for you.

$0 monthly maintenance fee

with $250 minimum daily balance

Earn interest

| Current APY* | Required Minimum Daily Balance To Earn APY* |

|---|---|

| 0.01% | $0.01 |

| *Annual Percentage Yield (APY) is accurate as of 12/22/20 and subject to change after the account is opened. Fees may reduce earnings on the account. | |

Banking that works for you

Td High Interest Savings Account Fees

- Earn interest on your account balance

- Rate discount on TD Bank home loans - .25% off home equity lines of credit1

Extras you'll truly use

- Free money orders

- Free official bank checks

- Free standard checks or discounts on select check styles

- Free paper statements

Save money

- $10 monthly maintenance fee waived when you maintain the $250 minimum daily balance

- Overdraft services available

On-the-go banking

- Free Mobile Banking with Mobile Deposit2

- Online Banking and free Bill Pay with e-bills

- Free online statements with check images

- Live Customer Service 24/7

Checkouts just got easier.

Pay with your TD Bank Debit Card

- In person

- Online or over the phone

- In apps or app stores

- Using your digital wallet

Open an account

Apply online

minutes or less.

Call us

help you over the phone.

Td High Interest Savings Account

Apply in person

1Loans subject to credit approval. Relationship discount may be terminated and the interest rate may increase upon closure of the qualifying personal checking account.

2TD Bank Mobile Deposit is available to Customers with an active checking, savings or money market account and using a supported, internet-enabled iOS or Android device with a camera. Other restrictions may apply. Please refer to the Mobile Deposit Addendum.

Compare | CheckingSM | |||||

|---|---|---|---|---|---|---|

| Monthly maintenance fee | with a minimum daily balance of $100 —OR— $15 | with a minimum daily balance of $2,500 —OR— $25 | with a $20,000 minimum combined deposit, outstanding loan and/or mortgage balance (excludes credit card) —OR— $25 | with a minimum daily balance of $250 —OR— $10 | ||

| Earns interest | ||||||

| Checks | ||||||

| Online statements | ||||||

| Paper statements | (Paper statements are optional for Online Banking customers) | (Paper statements are optional for Online Banking customers) | (Paper statements are optional for Online Banking customers) | |||

| ATM fees | Other banks' ATM fees reimbursed with a minimum daily balance of $2,5001 | Other banks' ATM fees reimbursed with a minimum daily balance of $2,5001 | ||||

| Overdraft protection | ||||||

| Free with this account | Official bank checks Stop payments Incoming wire transfers | Official bank checks Stop payments Incoming wire transfers No monthly maintenance fee on savings accounts and one additional checking account | Official bank checks |

Free Mobile Banking with Mobile Deposit3

Online Banking and free Bill Pay with e-bills

TD Bank Debit Card available on-the-spot

Live Customer Service 24/7

Free access at thousands of TD ATMs in the U.S. and Canada

Flexible ways to Send Money via text or e-mail and make internal and external transfers3

Free online statements with check images

Rate discounts on TD Bank home loans - .25% off home equity line of credit4

Choice of overdraft services available

Open early. Open late. Most locations open 7 days

Alternate format statements available, learn more about TD Bank accessibility options.

Checkouts just got easier.

Pay with your TD Bank Debit Card

- In person

- Online or over the phone

- In apps or app stores

- Using your digital wallet

Open an account

Apply online

minutes or less.

Call us

help you over the phone.

Apply in person

1Non-TD fees reimbursed when minimum daily balance is at least $2,500 in checking account. For non-TD ATM transactions, the institution that owns the terminal (or the network) may assess a fee (surcharge) at the time of your transaction, including balance inquiries.

2TD Bank Mobile Deposit is available to Customers with an active checking, savings or money market account and using a supported, internet-enabled iOS or Android device with a camera. Other restrictions may apply. Please refer to the Mobile Deposit Addendum.

3Send Money is available for most personal checking and money market accounts. External transfer services are available for most personal checking, money market and savings accounts. To use either of these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, an active unique e-mail address, and a Social Security Number. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. To perform instant transfers a TD Bank Visa® Debit Card is required. Fees may apply depending on delivery options.

4Loans subject to credit approval. Relationship discount may be terminated and the interest rate may increase upon closure of the qualifying personal checking account.

©2019 Visa U.S.A. Inc.

You might also be interested in:

- TD Debit Card AdvanceSM: a discretionary overdraft service

(Important Information about TD Debit Card Advance)

TD Canada Trust offers you the option of a High Interest TFSA Savings Account or GICs and Term Deposits within a TFSA. Both protect your principal investment and offer predictable returns.

High Interest TFSA Savings Account

The High Interest TFSA Savings Account puts you in control of your money.

It offers you –

- A competitive interest rate so you can enjoy tax-free growth in a high-yield registered savings account

- Steady, predictable returns

- Flexible access to your money

- The convenience of Pre-Authorized Transfer Service

- Eligibility for coverage under the Canada Deposit Insurance Corporation (CDIC)

Td High Interest Savings Account

GICs, Term Deposits and your TFSA

If you’re looking for guaranteed principal and interest in a low-risk investment, then Guaranteed Investment Certificates (GICs) and Term Deposits could be the right fit for your TFSA.

- You get a solid, secure investment with no surprises

- Your principal is fully protected, and interest rates are guaranteed1

- You have the comfort of steady, predictable investment returns

- You can choose from a full range of terms, as well as innovative features that combine premium rates with investment flexibility

- Your investments are eligible for coverage under the Canada Deposit Insurance Corporation (CDIC)

Ask about our Market Growth GICs2

- Returns on Market Growth GICs are linked to changes in leading stock market indices

- Market Growth GICs provide growth potential while guaranteeing your principal

To open a TD Canada Trust TFSA, simply visit any TD Canada Trust branch, call 1-866-222-3456 or apply online now.

Td Interest Rates Savings

2 The principal amount of a Market Growth GIC will be repaid at maturity. Changes in the index to which the return on a Market Growth GIC is linked will affect the interest payable on the GIC. Interest is payable only up to a maximum amount set at the time of purchase. No interest will be payable in the event that the index to which the return on the GIC is linked has declined or does not change from its level at the time of purchase. Market Growth GICs are not redeemable prior to maturity. A disclosure statement with complete details of the features of Market Growth GICs is available at any TD Canada Trust branch.