Recurring Deposit Interest

- Recurring Deposit Interest Rates In Hdfc Bank

- Recurring Deposit Interest Rate Calculator

- Recurring Deposit Interest Rates 2018

- Recurring Deposit Interest Rates In Post Office

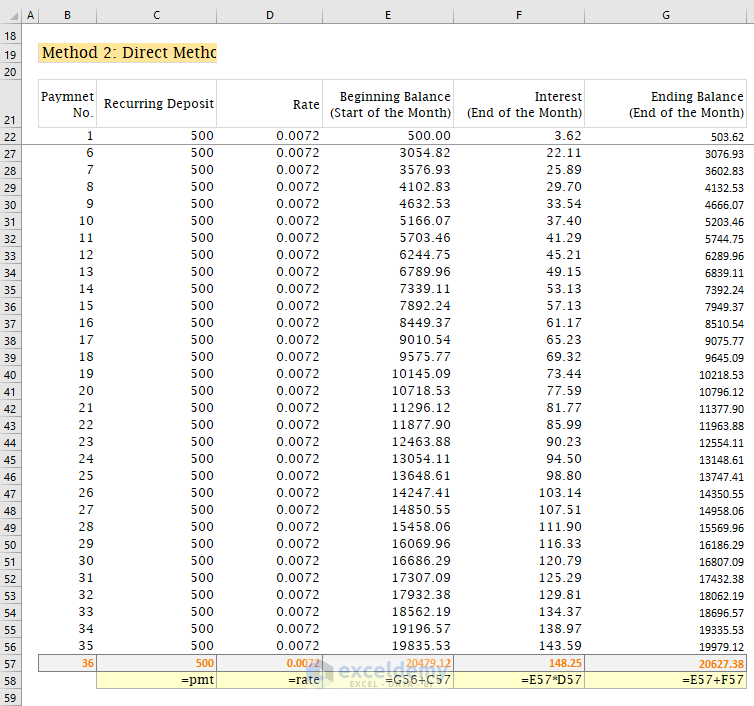

- Recurring Deposit Interest Formula

- Recurring Deposit Interest Formula

Recurring Deposit Invest fixed sum of amount on monthly basis in Recurring Deposit and get attractive interest rates. Recurring Deposit allows customers with an opportunity to build up their wealth securely through regular monthly deposit of fixed sum over a period of time.

A recurring deposit is a special kind of term deposit offered by banks which help people with regular incomes to deposit a fixed amount every month into their recurring deposit account and earn interest at the rate applicable to fixed deposits.[1] It is similar to making fixed deposits of a certain amount in monthly installments. This deposit matures on a specific date in the future along with all the deposits made every month. Recurring deposit schemes allow customers an opportunity to build up their savings through regular monthly deposits of a fixed sum over a fixed period of time. The minimum period of a recurring deposit is six months and the maximum is ten years.[2]

The recurring deposit can be funded by standing instructions which are the instructions by the customer to the bank to withdraw a certain sum of money from his/her savings/current account and credit to the recurring deposit account.

When the recurring deposit account is opened, the maturity value is indicated to the customer assuming that the monthly installments will be paid regularly on due dates. If any installment is delayed, the interest payable in the account will be reduced and will not be sufficient to reach the maturity value. Therefore, the difference in interest will be deducted from the maturity value as a penalty. The rate of penalty will be fixed upfront. Interest is compounded on quarterly basis in recurring deposits.

- Invest small amounts on regular basis by opening a Recurring Deposit (RD) account with Equitas and earn interest as high as fixed deposits.Invest in small portions starting from Rs. 1000/- pm with tenure options from 12 months to 10 years. Senior citizens will get a special rate of interest.

- Recurring Deposit Interest Rates for 1 Year (as on 02 Mar 2021) The highest interest rate is offered by North East Small Finance Bank Limited (for 12 months) at 7.5% and Utkarsh Small Finance Bank (for 12 months) at 7.25% followed by Suryoday Small Finance Bank (for 12 months) at 7.25%.

- Recurring Deposit Interest Rates for 1 Year (as on 02 Mar 2021) The highest interest rate is offered by North East Small Finance Bank Limited (for 12 months) at 7.5% and Utkarsh Small Finance Bank (for 12 months) at 7.25% followed by Suryoday Small Finance Bank (for 12 months) at 7.25%.

- Are you looking for an investment opportunity where you can make regular savings and earn interest? A Recurring Deposit (RD) may be the answer for you. You can make small contributions at regular intervals and get rewarded with interest on your savings.

One can avail loans against the collateral of a recurring deposit up to 80 to 90% of the deposit value.[1]

The rate of interest offered is similar to that of fixed deposits.[1]

Recurring Deposit Interest Rates In Hdfc Bank

The formula to calculate the interest is given as under: where I is the interest, n is time in months and r is rate of interest per annum and P is the monthly deposit.[3]

The formula to calculate the maturity amount is as follows:Total sum deposited+Interest on it .

Taxation[edit]

Tax deducted at source (TDS) is applicable on recurring deposits. If interest earned on recurring deposits exceeds Rs. 40,000 a year, TDS at the rate of 10% would be deducted by the bank. Income tax is to be paid on interest earned from a Recurring Deposit at the rate of tax slab of the Recurring Deposit holder. Investors with no taxable income will have to submit form 15G to avoid TDS on both recurring deposits and fixed deposits. However, for investors who are senior citizens (above the age of 60) you will have to file form 15H to avoid TDS on both RD and FD. [4]

References[edit]

- ^ abc'From Post Office RD, Bank RD to Debt MF SIP, find out your option for risk-free recurring deposits'. 13 June 2019. Retrieved 23 June 2019.

- ^Vijayaragavan Iyengar (2009). Introduction to Banking. Excel Books India. pp. 313–. ISBN978-81-7446-569-6.

- ^M.L. Aggarwal. APC Understanding ICSE Mathematics - Class 10 - Avichal Publishing Company. Avichal Publishing Company. pp. 58–. ISBN978-81-7739-302-6.

- ^Sharma, Ashwini Kumar (2020-04-20). 'Avoid unnecessary TDS, furnish form 15G and 15H'. mint. Retrieved 2020-10-20.

Recurring Deposit Interest Rate Calculator

Recurring Deposit Interest Rates for 1 Year (as on 06 Mar 2021)

The highest interest rate is offered by North East Small Finance Bank Limited (for 12 months) at 7.5% and Utkarsh Small Finance Bank (for 12 months) at 7.25% followed by Suryoday Small Finance Bank (for 12 months) at 7.25%.

| Bank | Interest Rate (p.a.) | Calculate |

|---|---|---|

| Idfc Bank | 7.25% | |

| Indusind Bank | 7.00% | |

| Rbl Bank | 7.00% | |

| Yes Bank | 6.75% | |

| Allahabad Bank | 6.75% | |

| The Nainital Bank | 6.70% | |

| Dcb Bank | 6.50% | |

| United Bank Of India | 6.50% | |

| Standard Chartered Bank | 6.30% | |

| Laxmi Vilas Bank | 6.00% |

Recurring Deposit Interest Rates 2018

Recurring Deposit Interest Rates for 2 Years (as on 06 Mar 2021)

The highest interest rate is offered by North East Small Finance Bank Limited (for 2 years) at 8.00% and Utkarsh Small Finance Bank (for 2 years) at 7.25% followed by Suryoday Small Finance Bank (for 2 years) at 7.25%.

Recurring Deposit Interest Rates In Post Office

| Bank | Interest Rate (p.a.) | Calculate |

|---|---|---|

| Idfc Bank | 7.25% | |

| Indusind Bank | 7.00% | |

| Rbl Bank | 7.00% | |

| The Nainital Bank | 6.90% | |

| Dcb Bank | 6.80% | |

| Yes Bank | 6.75% | |

| Allahabad Bank | 6.60% | |

| United Bank Of India | 6.25% | |

| Standard Chartered Bank | 6.20% | |

| Bandhan Bank | 6.00% |

Recurring Deposit Interest Rates for 3 Years (as on 06 Mar 2021)

The highest interest rate is offered by Suryoday Small Finance Bank (for 3 years) at 8.10% and North East Small Finance Bank Limited (for 3 years) at 8.00% followed by RBL Bank Limited (for 3 years) at 7.25%.

| Bank | Interest Rate (p.a.) | Calculate |

|---|---|---|

| Idfc Bank | 7.25% | |

| Rbl Bank | 7.25% | |

| Dcb Bank | 6.95% | |

| The Nainital Bank | 6.90% | |

| Yes Bank | 6.75% | |

| Indusind Bank | 6.75% | |

| Allahabad Bank | 6.50% | |

| United Bank Of India | 6.25% | |

| Standard Chartered Bank | 6.00% | |

| Laxmi Vilas Bank | 6.00% |

Recurring Deposit Interest Rates for 4 Years (as on 06 Mar 2021)

The highest interest rate is offered by Suryoday Small Finance Bank (for 4 years) at 7.75% and Fincare Small Finance Bank Ltd (for 4 years) at 7.30% followed by Utkarsh Small Finance Bank (for 4 years) at 7.25%.

| Bank | Interest Rate (p.a.) | Calculate |

|---|---|---|

| Idfc Bank | 7.25% | |

| Dcb Bank | 6.95% | |

| The Nainital Bank | 6.90% | |

| Indusind Bank | 6.75% | |

| Yes Bank | 6.75% | |

| Rbl Bank | 6.75% | |

| Allahabad Bank | 6.50% | |

| Laxmi Vilas Bank | 6.00% | |

| Standard Chartered Bank | 6.00% | |

| United Bank Of India | 6.00% |

Recurring Deposit Interest Rates for 5 Years (as on 06 Mar 2021)

The highest interest rate is offered by Suryoday Small Finance Bank (for 5 years) at 8.25% and Utkarsh Small Finance Bank (for 5 years) at 7.25% followed by DCB Bank Limited (for 5 years) at 6.95%.

| Bank | Interest Rate (p.a.) | Calculate |

|---|---|---|

| Idfc Bank | 7.25% | |

| Dcb Bank | 6.95% | |

| The Nainital Bank | 6.90% | |

| Indusind Bank | 6.75% | |

| Yes Bank | 6.75% | |

| Rbl Bank | 6.75% | |

| Allahabad Bank | 6.50% | |

| Deustche Bank | 6.25% | |

| Laxmi Vilas Bank | 6.00% | |

| Standard Chartered Bank | 6.00% |

Recurring Deposit Interest Formula

Recurring Account Key Features

Recurring Deposit Interest Formula

- One of the best way of investment of your savings which is offered by almost all the banks in India.

- It facilitates small savings with flexible amounts and tenures.

- It inculcates a regular habit of saving for future needs.

- It is available from minimum of 6 months to a maximum of 10 years with monthly instalments of 12, 24, 36, 48, 60, 72, 84, 96, 108 and 120 months.

- It can be opened for monthly instalments of Rs 100 and thereafter, in multiples of Rs 100.

- Once the RD account becomes active, the customer can not change the amount of the installment or the tenure.

- Standing instruction for transferring the monthly instalments from the customer's SB / CA account is accepted.

- Very popular among the salaried class persons.

- Best for those who can afford to save only a few thousand rupees per month.

- Almost all the banks do quarterly compounding in case of RD.

- On maturity date, the RD holder is paid the maturity value i.e. the principal and the interest earned.

- RD accounts can be prematurely closed and banks generally deduct some penalty as per the clauses of the bank.

- Partial withdrawals are not allowed.

- A penalty is levied upon a delayed payment or missing installment.

- Some banks have a loan facility against the RD on pledging the RD as collateral.

- Nomination facaility is available.